georgia film tax credit application

If the production company. The verification reviews will be done on a first comefirst serve basis.

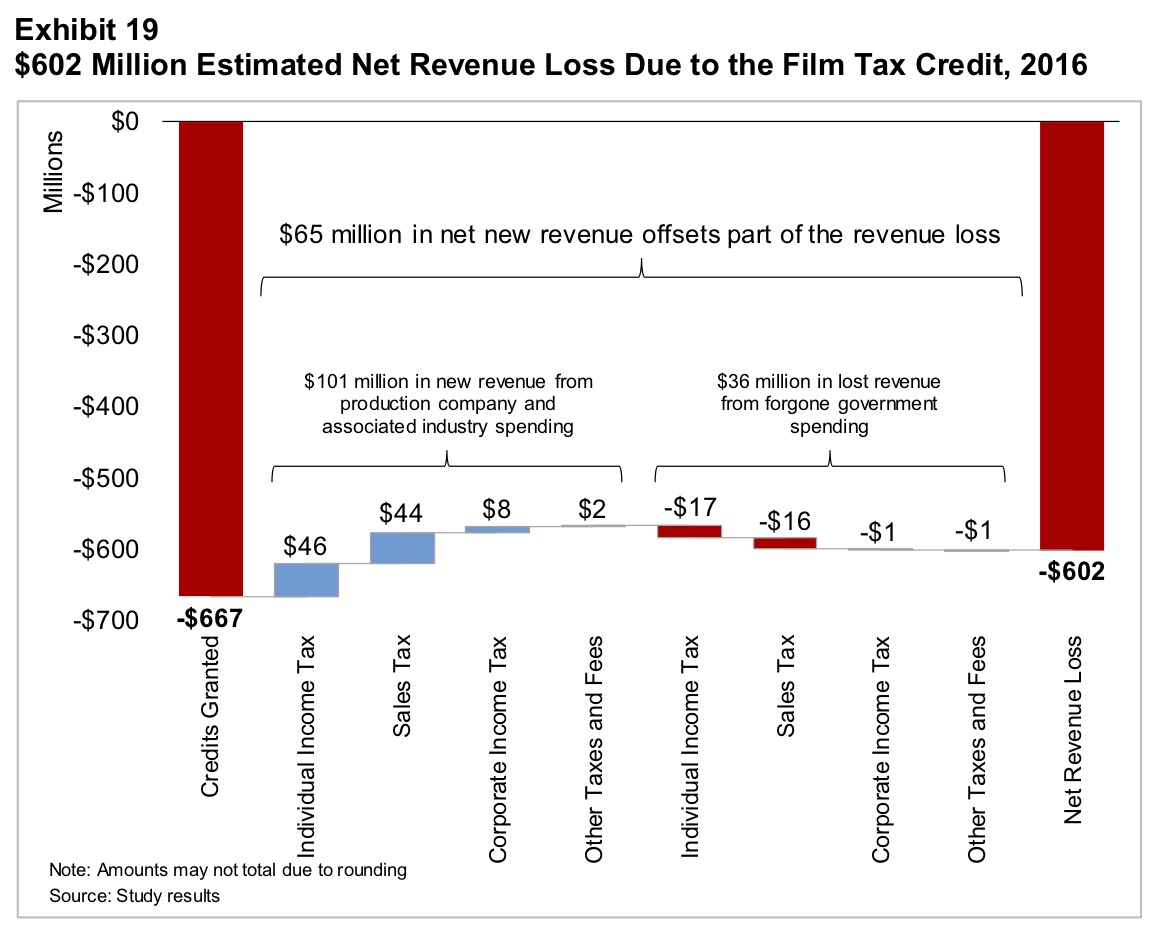

Are Film Tax Credits Cost Effective Los Angeles Times

The Georgia film tax credit program accepts applications for live-action projects within 90 days of the start of principal photography but must be done before the end of.

. Local state and federal government websites often end in gov. Tax Credit Certification Application. 159-1-1-03 Film Tax Credit Certification.

159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production. In 2008 Georgia passed OCGA. Mandatory Film Tax Credit Process for Production Companies on the Georgia Tax Center not applicable to Qualified Interactive Entertainment Production Companies 7-8-16 1.

Georgia Tax Credit Application - Cognito Forms. Company may receive certification. The income tax credit may be used against Georgia income tax liability or the production companys Georgia withholding or.

159-1-1-04 Base Tax Credit. Can sell or transfer the. Click to learn additional information and to obtain the GDORs application form.

Certification for live action projects will be through the Georgia Film Office. As cited in the Georgia Code Section 48-7-4026 the Georgia Entertainment Industry Investment Act for any. Certification may be applied for within 90 days of the start of principal photography but before the end of principal.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The following documentation provides information on reporting film tax credit and applying for a film tax credit audit via the Georgia Tax Center GTC. Direct contact for an audit.

Beginning January 1 2021 mandatory. To apply for the 20 certification for feature films television pilots television series and music videos a production company must. A complete the 20 percent certification application per.

Complete Complete the information below listing the primary and secondary representatives who have authority to act on behalf of the firm and who will have overall responsibility for Film Tax. 48-7-4026 to further entice. Applying for the full 30 tax credit the application package consists of the 20 and 10 applications proof of funding and script.

Final tax credit certification is not required for any project that is certified by the Film Office from 1121 to 123121 if it seeks 25 million or less in tax credits through its DOR tax credit. For example in 2005 Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state. Only production companies are eligible to apply.

In preparation for submitting a Mandatory Film Tax Credit Audit Application the production should have the following document information. There is a tiered system that is based on the estimated tax credit. Not all productions are required to comply with the new application process starting January 1 2021.

Georgia Film And Tv Tax Credit Jumps To A Record 1 2 Billion Variety

/cdn.vox-cdn.com/uploads/chorus_asset/file/9090113/GeorgiaFilming_BUG_Getty_Ringer.jpg)

How Atlanta Is Taking Over The Entertainment Industry The Ringer

Another Reason Why The Economic Impact From Georgia S Film Incentives Is Still Overstated

State Senate Panel Pushes Film Tax Break Cap In Altered Income Tax Cut Plan Georgia Recorder

Bill To Update Georgia Film Tax Credit 11alive Com

Hb 441 Would Strip Georgia S Film Tax Credit 11alive Com

Essential Guide Georgia Film Tax Credits Wrapbook

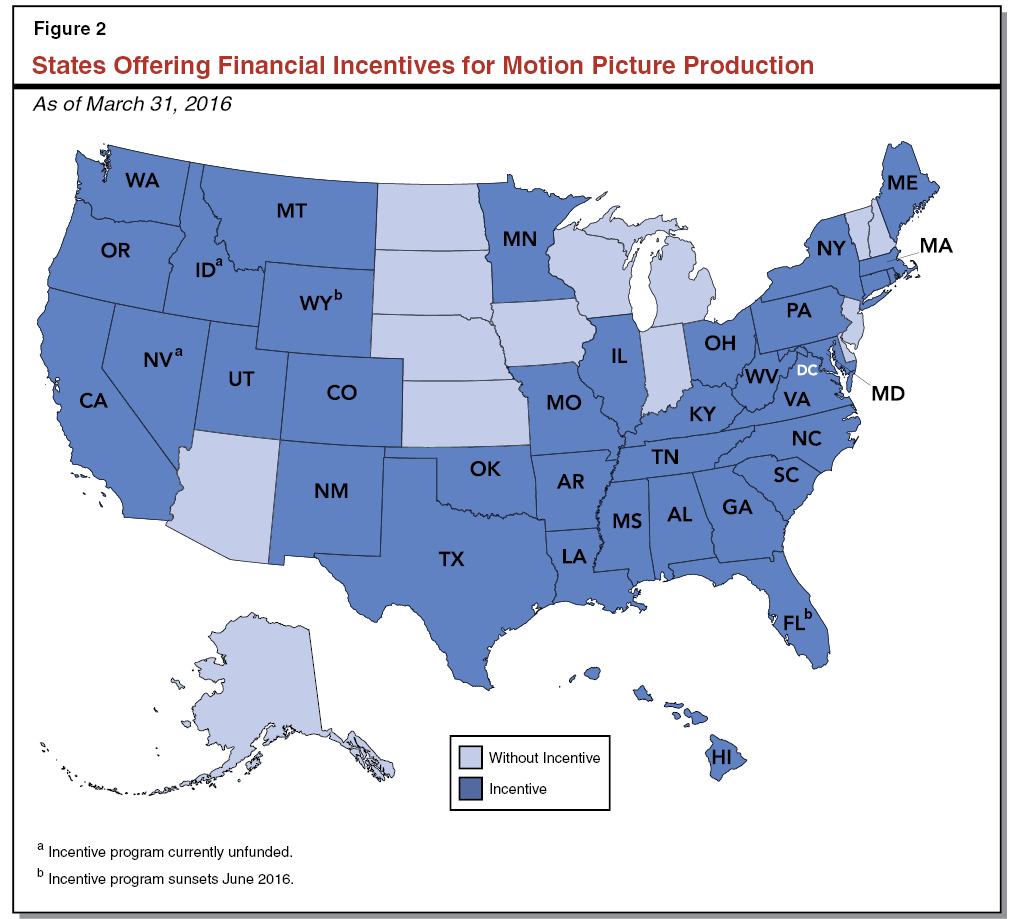

Competition From Other States Increasing Pressure On Georgia S Film Industry

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

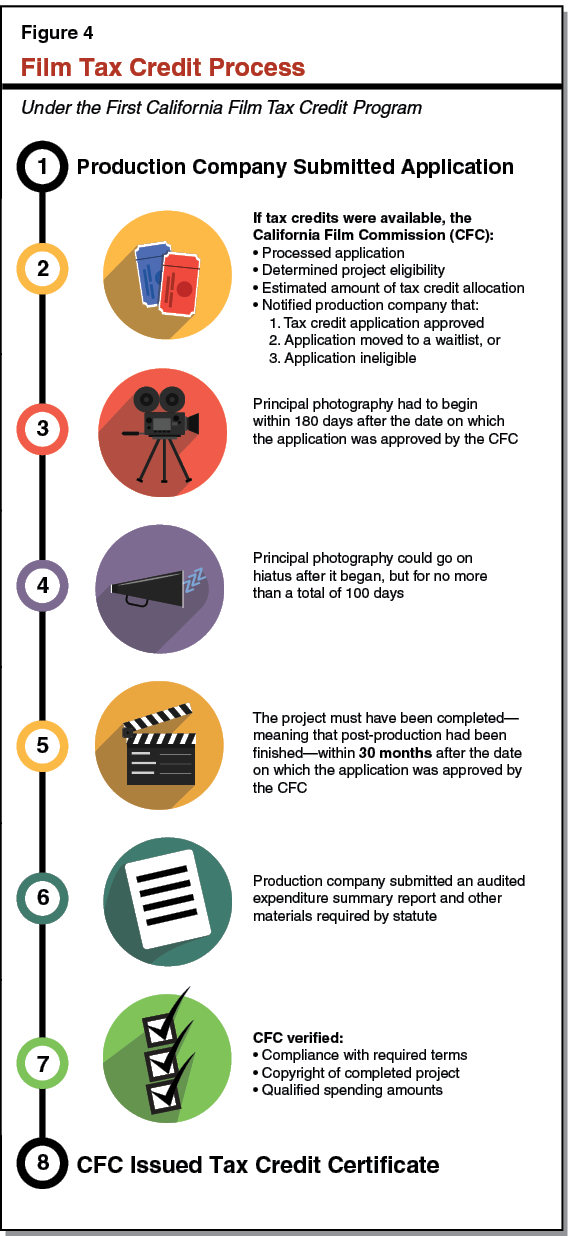

California S First Film Tax Credit Program

Outrider Georgia Film Tax Credits

Georgia Film Tax Credit Program Is Ideal For Fraud Report Finds Project Casting

Essential Guide Georgia Film Tax Credits Wrapbook

2013 10 Gep Logo Uplift Tax Credit Application Georgia

Changes Gerogia Film Tax Credit

California S First Film Tax Credit Program

Georgia Film Tax Credits Os State Film Tax Credits

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline